Market Making

A New Paradigm for Our Ecosystem

Market Making and High-Frequency Trading

Athena's venture into market making signifies a groundbreaking shift towards optimizing liquidity and trading volumes. By engaging in Market Maker Programs on Centralized Exchanges (CEXs), Athena leverages high-frequency trading strategies to offer reduced fees and reward-based incentives, directly correlated with the exchange-generated trade volume. This strategic endeavor not only expands NFA Labs' footprint in the centralized exchange domain but also underscores a commitment to innovation and collaboration, fostering enhanced market visibility and investor confidence through improved liquidity and price stability.

Historical Volume Achievements

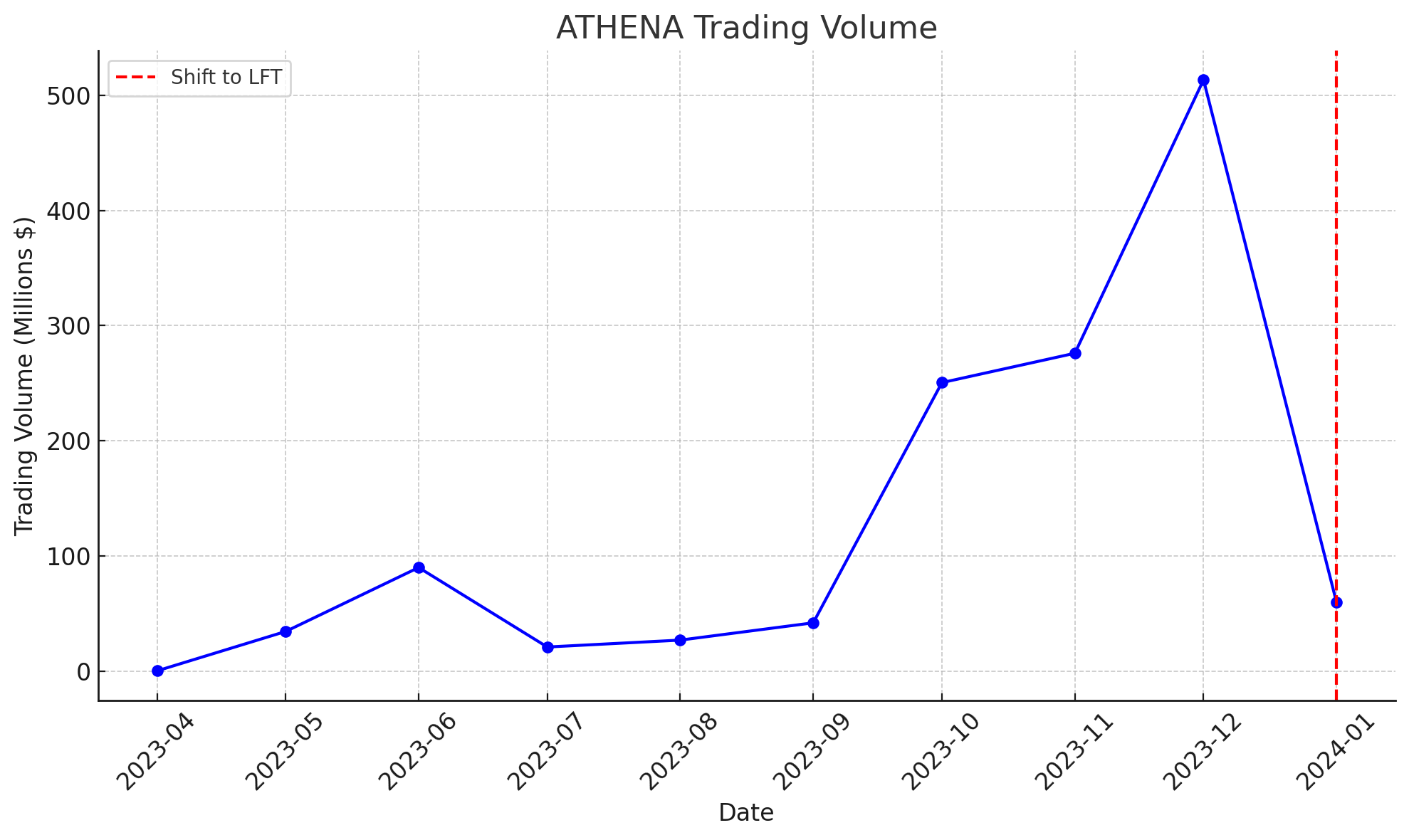

Since its inception, Athena's market-making strategies have charted a trajectory of exponential growth, escalating from an initial trading volume of approximately $291,531 in April 2023 to a staggering $513 million over a 30-day period by December.

This remarkable expansion demonstrates Athena's effectiveness and the potent capabilities of its neural network algorithms, contributing significantly to liquidity enhancement and fostering a stable trading environment.

Revenue Generation

Volume of Trades: A Core Revenue Driver

A primary revenue pillar for market makers is the volume of trades they facilitate. Market makers earn a commission or capture a fraction of the spread on each trade, with earnings scaling in direct proportion to the trade volume. High-frequency trading strategies, employed by entities like Athena, excel in maximizing trade volume, thereby amplifying revenue potential through sheer transaction quantity.

Capitalizing on the Bid-Ask Spread

The bid-ask spread, the differential between the buying price and the selling price, serves as a critical profit source for market makers. By continuously placing buy and sell orders around the market price, market makers like Athena can buy at lower prices and sell at slightly higher prices, profiting from the spread. This strategy's effectiveness is contingent upon the market maker's ability to predict price movements and manage inventory efficiently.

Leveraging Market Maker Incentives

Exchanges often implement incentive programs to attract and retain market makers, offering rebates or reduced fees as a reward for contributing liquidity. These incentives can significantly augment a market maker's earnings, making them a vital component of the revenue model. Athena's participation in such programs exemplifies strategic engagement with exchange ecosystems to enhance profitability while bolstering the market's liquidity.

Navigating Market Conditions for Profit Optimization

Market volatility and conditions play a pivotal role in shaping market-making revenue. In periods of high volatility, the bid-ask spread tends to widen, presenting opportunities for increased profits. However, this comes with heightened risk, necessitating advanced predictive models and risk management strategies to capitalize on these conditions without incurring substantial losses.

Fee Structures: The Impact on Earnings

The fee structure of an exchange directly influences market-making profitability. Exchanges typically offer differentiated fees for market makers (who add liquidity) and takers (who remove liquidity), with market makers often enjoying lower fees. Some exchanges offering a tiered fee structure, which rewards higher trading volumes with lower fees, benefits market makers like Athena, enabling them to optimize their earnings through strategic trade volume management.

A Multidimensional Revenue Model

The revenue model for market makers in centralized exchanges is a composite of trading volumes, spreads, incentive programs, market conditions, and fee structures. Athena's engagement in market making exemplifies a comprehensive strategy that leverages each of these facets to generate revenue. By continuously adapting to market dynamics, optimizing for exchange incentives, and employing advanced trading algorithms, Athena not only contributes to the liquidity and stability of the trading environment but also secures a profitable stance in the competitive landscape of market making.

Exchange Benefits

Athena's integration into tier-1 exchanges through market making not only generates substantial revenue but also brings considerable advantages to the exchanges themselves. By ensuring a consistent provision of liquidity and facilitating tighter spreads, Athena enhances the overall trading experience, attracting a broader investor base and elevating the exchange's competitive edge in the market.

Legal Framework for Market Making

Embarking on market-making endeavors within tier-1 exchanges necessitates a robust legal framework, an area where NFA Labs is making significant strides through a DAO wrapper. This comprehensive approach, developed in collaboration with DAObox and legal advisor John MacPherson, encompasses all required legal documentation and compliance measures, enabling Athena's effective participation in market-making initiatives. This meticulous preparation underscores NFA Labs' dedication to compliance, security, and long-term project sustainability.

Strategic Collaborations and Future Directions

Athena's market-making initiative is poised for future expansion, with plans to deepen collaborations within the DeFi and centralized exchange landscapes. These partnerships will not only enhance Athena's market-making capabilities but also drive forward innovations in liquidity provision and trading strategies. As Athena continues to evolve, its integration with tier-1 exchanges is expected to set new benchmarks in trading efficiency, revenue generation, and ecosystem growth, reinforcing NFA Labs' position at the forefront of DeFi innovation.

Last updated

Was this helpful?